Who’s thisinsurance for?

Health Insurance

Self

Ideal for individuals & working professionals

Self (Investor)

Best for investor visa or partner visa holders

Self & Dependent

Protect yourself along with spouse/children

Self (Investor) & Dependent

Complete care for investor & their dependents

Dependent Only

Covers children, parents or sponsored members

Investor’s Dependent Only

Only cover your investor family members

Health Insurance

Self

Investor

Parents

Golden Visa

What Is Health Insurance?

Health insurance in the UAE is a financial safeguard that helps you manage medical expenses when you fall ill or face accidents. By paying regular premiums, you gain protection against costs related to hospitalisation, surgery, maternity and pediatric care,emergency and day-care treatments, as well as pre- and post-hospitalisation services. With eSanad, you can compare health insurance plans,get instant online quotes, and enjoy a completely paperless experience—fast, secure, and tailored to your needs.

Why You Need Health Insurance

You need health insurance for several important reasons

Financial Protection

Protect yourself from unexpected medical bills by choosing a plan that helps you avoid high out-of-pocket costs during illness or accidents.

Rising Healthcare Costs

With medical expenses increasing at a rapid pace, having health insurance ensures that you stay financially prepared to handle them.

Coverage for Chronic/Critical Illness

Coverage can include benefits for chronic or critical illnesses, helping you stay financially secure during the most critical moments.

Health insurance is a safeguard that helps you manage the costs when you fall ill or face accidents. You pay regular premiums, and in return, eSanad helps cover expenses for hospitalisation, surgery,

Health insurance is a safeguard that helps you manage the costs when you fall ill or face accidents. You pay regular premiums, and in return, eSanad helps cover expenses for hospitalisation, surgery, day-care treatments, pre- and post-hospitalisation care, and other medical costs depending on the plan you choose.

Benefits of Health Insurance by eSanad

You need health insurance for several important reasons:

Coverage for hospitalisation (illness/accident/critical illness) including surgeries and day-care procedures.

Pre- and post-hospitalisation expenses covered as per plan.

Optional benefits like organ donor cover, mental health hospitalisation, home hospitalisation/domiciliary care where relevant.

Wallet / restoration of sum insured benefit in certain plans (e.g. if your base cover is used up, additional backup cover kicks in).

No room rent capping in some plans or flexible room rent options.

Reduction of premium / discounts for healthy lifestyle, family floater option, or when availing services from network hospitals.

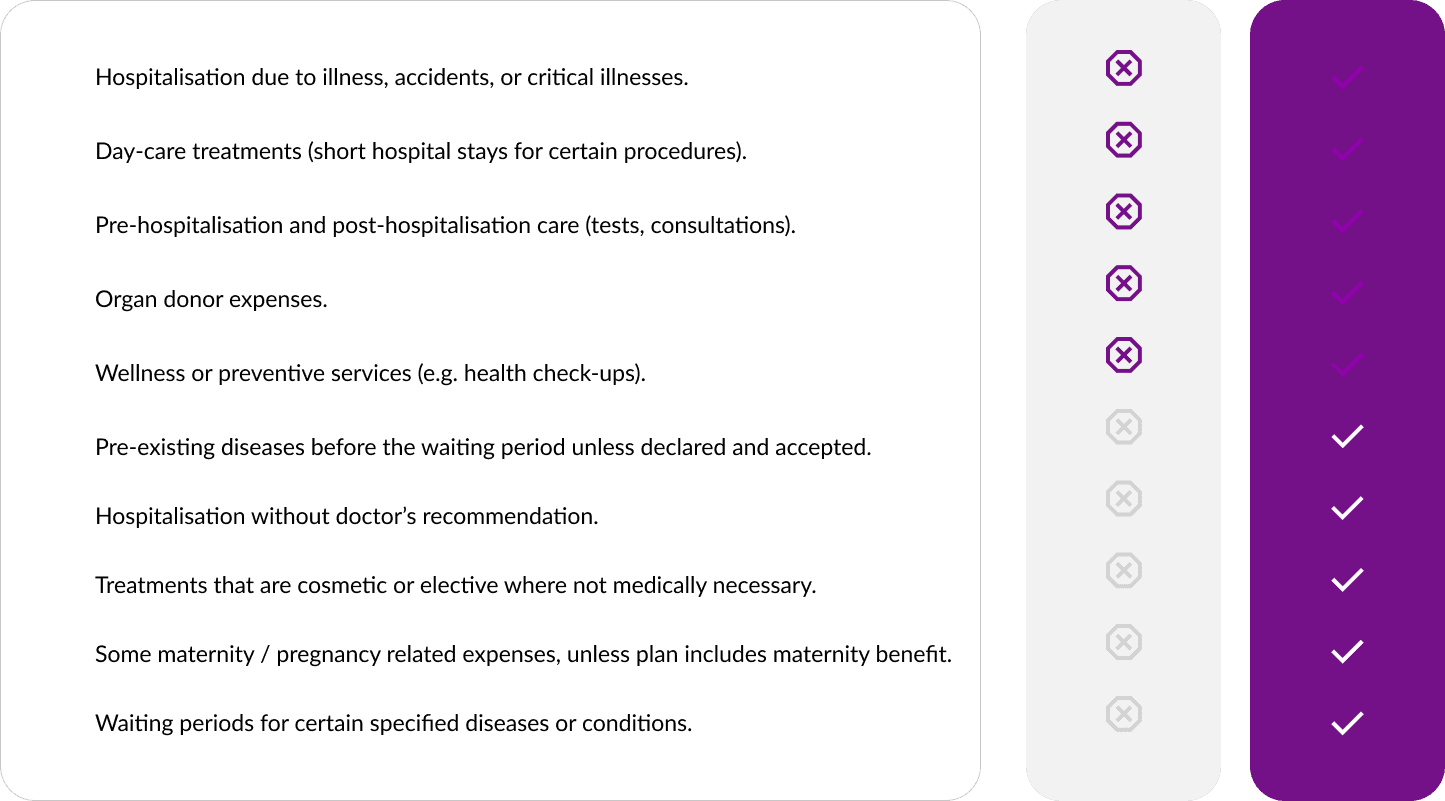

What’s Covered & What’s Not,

You need health insurance for several important reasons:,

Why Choose eSanad Health Insurance

You need health insurance for several important reasons

Simple, fully online process: from buying to renewing to making claims—all digital.

No age-based / zone-based co-payment (if applicable) depending on plan.

Flexibility in choosing hospital room options.

Wellness perks: preventive care, telemedicine, health check-ups, mental health support.

Wide cashless hospital network.

Transparent policy terms, and good claim settlement history.

Visit eSanad website or app.,

Visit eSanad website or app.

Enter basic details (age, family size, health history) to compare plans.

Complete medical/health declarations. If required, undertake medical tests.

For renewals, follow similar process; ensure you renew on time to keep cover in force.

Make payment; policy document will be issued digitally.

Visit eSanad website or app.,

Enter basic details (age, family size, health history) to compare plans.,

Complete medical/health declarations. If required, undertake medical tests.,

For renewals, follow similar process; ensure you renew on time to keep cover in force.,

Make payment; policy document will be issued digitally.,

How to Calculate Health Insurance Premiums

Age & health status

Sum insured chosen

Add-ons / riders selected

Type of plan (individual / floater / senior)

Your location (cost of medical care there)

Lifestyle factors (smoking, pre-existing conditions)

Type of plan (individual / floater / senior)

Waiting period and any co-payment or deductible

In case of hospitalisation, inform eSanad as per policy norms.

For cashless claims, use network hospitals and submit required documents (identity, policy, estimates, hospital bills).

For reimbursement claims (non-network), pay and later submit bills, prescriptions etc for reimbursement.

Track status via app/website/helpline.

Why Customers Trust eSanad Health Insurance?

Because we make health protection simple, transparent, and reliable. From easy online processes to quick claim settlements, eSanad is committed to making healthcare affordable and accessible for everyone. Customers choose us for our wide hospital network, honest policies, and customer-first approach.

How Health Insurance Claim Works

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Claim is initiated by you or the hospital.

Verification of documents by eSanad.

Process Complete & Settlement

After approval, payout is made (for reimbursement) or benefits settled (for cashless network hospital).

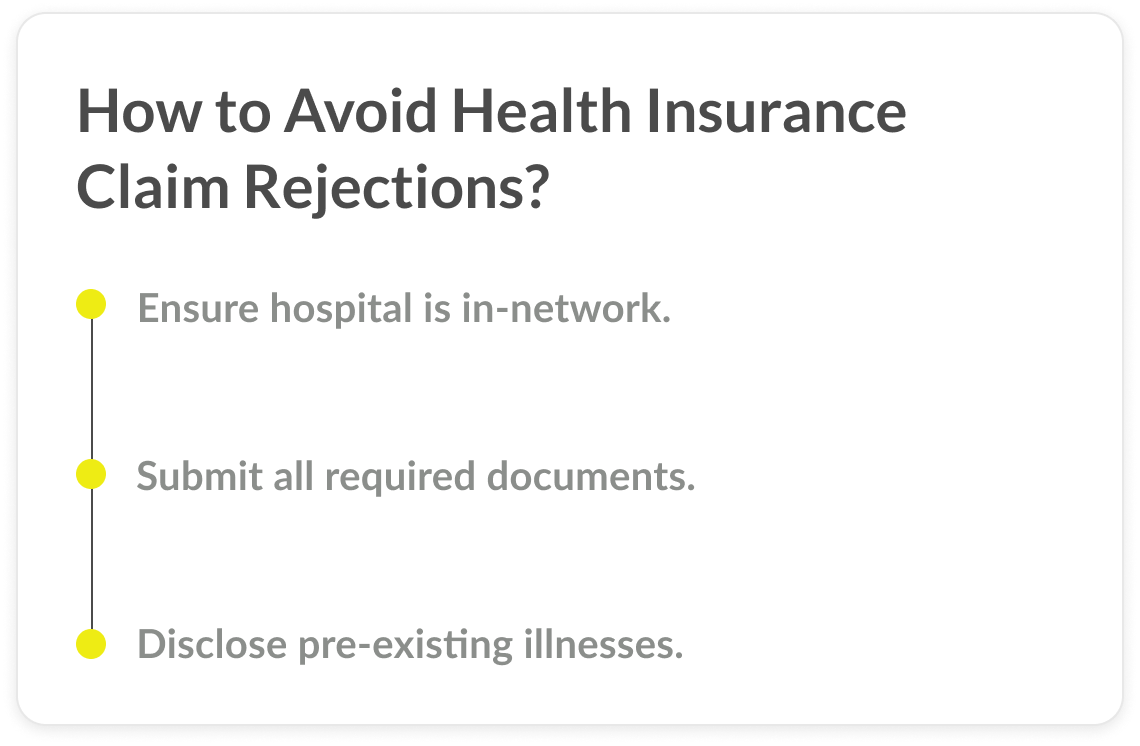

How to Avoid,Claim Rejections

Keep premium payments up to date.

Follow waiting periods.

Submit all required documents correctly.

Follow doctor’s recommendations and policies' terms.

Use network hospitals where cashless is applicable.

Tax Savings through Health Insurance

Premiums paid for health insurance may qualify for deductions under applicable tax laws. Coverage for parents may also bring additional benefits. Check local regulations for exact tax relief available.

What is an Ideal Coverage for a Health Insurance Plan?

An ideal health coverage should take care of hospitalisation, medicines, diagnostics, daycare treatments, and emergency needs without leaving you financially strained.

Consider your age and health condition.

Think about family members you want to cover.

Look at city of residence medical costs are higher in metros.

Factor in future healthcare inflation.

Choose a cover amount that gives peace of mind, not just the bare minimum.

Which Medical Insurance Plan is Perfect for You in Different Life Stages?

20s & 30s (Young professionals / newly married): Start early with affordable individual or family floater plans.

40s (Families with children / home loans): Higher sum insured with riders like critical illness.

50s & 60s (Pre-retirement / retired): Senior citizen plans or top-up coverage to manage higher health risks.

70s+ (Elderly): Plans focusing on long-term hospitalization and pre-existing conditions.

Which Medical Insurance Plan is Perfect for You in Different Life Stages?

7 Reasons to Choose the Best Health Insurance Plan

1

Assess healthcare needs – consider dependents, illnesses, lifestyle.

2

Decide on sum insured – factor in inflation and future risks.

3

Check waiting periods for pre-existing and specific illnesses.

4

Look at cashless hospital network near you.

5

Review add-ons – like maternity, wellness, or critical illness.

6

Compare premiums vs benefits – choose long-term value, not just lowest price.

7

Ensure lifelong renewability for continuous coverage.

What Our Customers Have to Say about Us

Our policyholders value the ease of buying, renewing, and claiming with eSanad. Many have shared how our cashless network and quick claim approvals provided them peace of mind during emergencies.

Steps to Select the Right Health Insurance Plan

Understand Your Needs

Understand Your Needs

Decide on the Coverage Amount –

Decide on the Coverage Amount –

Compare Plans

Compare Plans

Check Hospital Network

Check Hospital Network

Review Premium Affordability

Review Premium Affordability

Look for Add-Ons

Look for Add-Ons

Ensure Renewability

Ensure Renewability

Health Insurance Buying Tips for All Stages of Life

In Your 20s: Buy early for the lowest premium rates and minimal waiting periods.

In Your 40s: Consider higher sum insured and critical illness cover as responsibilities grow.

In Your 30s: Opt for family floater plans or maternity benefits if planning a family.

For Parents & Elders: Choose plans with coverage for pre-existing diseases and higher hospitalisation benefits.

In Your 50s & 60s: Secure senior citizen plans and super top-ups to manage age-related health issues.

Why eSanad is the Best Health Insurance Option for Everyone?

Transparency

No hidden clauses clear terms and conditions

Customizable Options

Add-ons and riders tailored to your needs.

Trusted Network

Wide list of hospitals for cashless treatment.

Digital First

Easy online purchase, renewals, and claims.

Comprehensive Coverage

From hospitalisation to wellness care.

Affordable Plans

High coverage at reasonable premiums.

What are the Tips to Compare Health Insurance Plans?

Always read policy exclusions carefully before buying.

Ensure add‑ons for unique risks (maternity, top‑up, critical illness).

Review cashless hospital network.

Check if the plan has room rent limits or sub‑limits on procedures.

Look for waiting periods on pre‑existing and specific diseases.

Compare sum insured vs premium to see best value.

What are the Tips to Compare Health Insurance Plans?

Here’s What Our Expert Has to Say About Buying Health Insurance the Right Way

“Don’t just look at the premium—look at the value. A slightly higher premium that covers critical illness or organ donor expenses is better than a cheaper plan that leaves gaps in protection. Always ensure the sum insured is adequate for your family’s future healthcare needs.”

Which Medical Insurance Plan is Perfect for Different Life Stages?

Young Professionals

Affordable Premiums. Wide Coverage. Maximum Protection. Smart Insurance for a Secure Tomorrow.

Family Coverage

Comprehensive Family Floater Plans. Complete Protection. One Premium, All Covered.

Senior Citizens

Specially Designed Plans with Age-Related Benefits & Higher Sum Insured for Complete Peace of Mind.

But Why eSanad Recommends ₹25 Lakhs Coverage?

Healthcare costs are rising fast. A ₹25 lakh coverage ensures you and your family are protected from unforeseen expenses, whether it’s major surgery,critical illness, or long-term hospitalisation.

Steps to Select the Right Health Insurance Plan

1

Assess your medical needs.

2

Decide your budget.

3

Compare plans.

4

Check claim settlement ratio.

5

Choose eSanad for complete peace of mind.

Our Expert Explains About Identifying the Ideal Health Insurance Coverage

Our health insurance experts recommend choosing coverage that matches your age,lifestyle, medical history, and future risks. With eSanad, you get flexible plans designed for every stage of life.

Health Insurance Buying Tips for All Stages of Life

Keep dependents covered.

Add riders if needed.

Always review your coverage before renewal.

Buy early for lower premiums.

How to Buy/Renew a Health Insurance Policy Online?

Visit eSanad website

Enter your details.

Choose your preferred plan.

Make the payment online.

Get instant policy issuance

Every policy plants trees—building a forest with your name.Protect your car today, and the planet tomorrow.

Yes, we'll still need cars. But until there's a better way to get around, we can all do our part for the environment. Together,let's reduce our footprint and make every drive a step toward a greener future.

Documents Required to Buy Health Insurance Online

ID Proof

Address Proof

Medical Reports (if required)

Age Proof

Documents Required to File a Health Insurance Claim

ID Proof

Address Proof

Age Proof

Medical Reports (if required)

Related Blogs

Frequently Asked Questions

Q2: Can I Have Multiple Health Insurance Policies in the UAE?

A: Yes, it's possible to have more than one health insurance policy in the UAE. This can be beneficial for extending your coverage or adding specific benefits that might not be available in a single policy.

Q3: How Can I Cancel My Health Insurance Policy in the UAE?

A: You can cancel your health insurance policy at any time. However, the refund policy will depend on the terms set by your health insurance provider. It's advisable to review these terms before cancellation to understand any potential financial implications.

Q4: Is Health Insurance Plan Portability Possible in the UAE?

A: Plan portability in the UAE depends on the policies of your current and potential new health insurance provider. If both allow for portability, you can transfer your health insurance plan to a new insurer, usually during the renewal period.

Q5: Can I Switch Health Insurance Providers Anytime in the UAE?

A: Yes, you have the flexibility to switch your health insurance provider in the UAE. This is typically done during the insurance renewal period, allowing you to choose a new plan that better suits your current health needs.

Q6: What Documents Do I Need for a Health Insurance Reimbursement Claim in the UAE?

A: For a health insurance reimbursement claim you generally need:

1. A completed reimbursement claim form.

2. Relevant medical reports (doctor’s notes, diagnostic reports).

3. Original paid invoices/receipts (hospital, pharmacy, lab).

Keep copies of all documents; insurers may ask for originals when processing the claim.

1. A completed reimbursement claim form.

2. Relevant medical reports (doctor’s notes, diagnostic reports).

3. Original paid invoices/receipts (hospital, pharmacy, lab).

Keep copies of all documents; insurers may ask for originals when processing the claim.

Q7: How Long Does It Take to Settle a Health Insurance Reimbursement Claim in the UAE?

A: The time taken to settle a health insurance reimbursement claim varies by provider. On average, it can take about 2-3 weeks. Some providers may offer faster processing times, so it's worth checking with your specific insurer.

Q8: Why Might a Health Insurance Claim Be Denied in the UAE?

A: Claims can be denied for several reasons, such as discrepancies in personal information, not disclosing pre-existing conditions, delays in informing the provider about the claim, or expiration of the insurance policy. It's crucial to provide accurate information and adhere to policy guidelines to avoid claim denials.

Q9: How Can I Enhance My Basic Health Insurance Coverage in the UAE?

A: To enhance your basic health insurance plan, you can add riders or add-ons. These provide additional protection against specific risks or medical needs that might not be covered under the standard plan.

Q10: Does UAE Health Insurance Cover All Diseases?

A: While UAE health insurance generally covers a wide range of diseases, it's essential to review your policy for specific terms of coverage, including any exclusions or limitations. Each policy may have different terms regarding what diseases and conditions are covered.

Related Content & Resources

Related Insurance Products

Health Insurance

Travel Insurance

Yacht Insurance

Property Insurance

Related Guides and Tools

Premium Estimator

Car Insurance Calculator

Coverage Comparison Tool

Related Blogs

Top 5 Things to Know Before Buying Car Insurance in UAE

Comprehensive vs Third-Party: Which One is Right for You?

Why Digital Insurance is the Future in UAE

Stay Covered, Stay Confident

Get your Health Insurance Quote today - secure your family’s well-being with comprehensive plans.

Company

- About Us

- Contact Us

- Location

- Travel Insurance

- Health Fine Calculator

- Investor Relations

Media & Insights

- Blogs & News

- Press Room

- Media Kit

- Download Center

- Events & Awards

- Employee login

Legal & Help

- Privacy Policy

- Disclaimer

- Terms of Use

- Licensing & Compliance

- Claim Your Policy Here

- Sitemap

- Complaints

- Cookies Notice

Partner With Us

- Become a Partner

- Insurance Providers

- Garages list

- Strategic Alliances

Success Insurance Services L.L.C. (eSanad): Licensed insurance broker in the UAE, regulated by the Central Bank of the UAE (CBAE), Registration No. 273.

Holder of Health Insurance Intermediary Permit (HIIP) from the Dubai Health Authority, Intermediary ID: BRK-0017.

Authorized by the Department of Health – Abu Dhabi (DOH) , Certificate No. 80.

Registered member of the Emirates Insurance Federation, Membership No. B1508.

Licensed member of the Abu Dhabi Chamber of Commerce and Industry (ADCCI) , No. 258509.

'eSanad' is a registered trademark of Success Insurance Services L.L.C., certified by the UAE Ministry of Economy & Tourism.

Insurance services provided exclusively through licensed UAE insurers. Subject to policy terms and conditions.

© 2026 eSanad. All rights reserved.